Overview

IR35 compliance is not easy

Determining employment status is often open to interpretation. Resolving these questions can be time consuming and frustrating.

Our software is an innovative IR35 digital tool that supports clients to comply with off-payroll working rules.

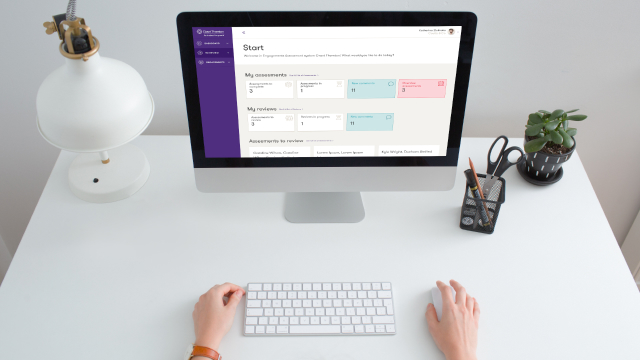

What can our IR35 software do for you?

You can assess and monitor the employment status of your contractor population, giving oversight to the teams that need it.

The entire process is controlled by you and your team.

Your assessments will fulfil HMRC's 'reasonable care' requirement.

Who can use our IR35 software?

Our IR35 platform is designed for organisations with more than 10 off-payroll workers (OPWs). If you have fewer than 10 OPWs you can still benefit from our assessments. We’ll do them for you.

How much does our IR35 assessment software cost?

The fee depends on how much you use it and the number of contracted employees you assess. The starting price point is £2,500 per annum plus individual assessment fees. You access the web-based platform through an annual software licence.

Features

(Employment Status Intelligence Platform)

- Online employment status assessments

- Status determination statements

- Contractor assessment can be emailed to the contractor and supply chain

- Supporting help text for assessment questions

- Result each time

- Peer-reviewed assessments

- Document repository

- Dispute management

- Reporting across your contractor population

- Part-completed assessments saved and recommenced later

- Role assessments for recruitment of contractors. These can be converted to full assessments with minimal effort

- Risk of challenge from HMRC or contractor indicated

- ISO27001 accreditation

- Builds a history of each OPW and creates an audit trail

- Notifies users of actions due

- Next assessment due reminders

HMRC's IR35 CEST tool

(Check Employment Status for Tax)

- Online employment status assessments

- Status determination statements

Why choose our IR35 software?

Our IR35 solution provides a decision in 100% of assessments

Statistics released by HMRC show that only 80% of IR35 assessments run through CEST produce an 'employed' or 'self-employed' outcome. The other 20% return a ‘cannot determine’ outcome, which leaves the user in limbo.

Our IR35 software returns an outcome for every single assessment and undertakes two assessments; one for % certainty employed and one for % certainty self-employed. The higher of the scores determines the result, with an associated ‘risk of challenge’ rating.

Subjectivity of input, reliability of employment status assessment output

One of the key requirements of IR35 legislation is for the end client to demonstrate ‘reasonable care’ in undertaking employment status assessments. This includes processes and controls over who is completing assessments and how the accuracy of input is determined.

We took this into consideration when designing the IR35 assessment workflow. Each completed assessment is peer-reviewed to support demonstration of reasonable care.

- The assessment is completed by the end client, not the contractor. This is because it is the end client who will be held responsible for the outcome by HMRC.

- The assessment is completed by an individual at the client who is closest to the working practices of the engagement, such as the hiring manager. It is reviewed by an approver, who has responsibility for IR35 compliance.

Our software considers the 7 key employment status indicators, including mutuality of obligation (MOO)

The IR35 software algorithm was developed by our team of employment tax experts. With many years of combined experience in employment status assessments and HMRC approach, we've designed a question set that covers the various categories that make up IR35 employment status.

FAQ

What is IR35? Your questions answered

What is IR35?

What does IR35 compliance require?

What is an employment status assessment?

When did the off-payroll working rules change?

Does IR35 apply to sole traders?

Can I stay outside IR35?

What is CEST?

How is HMRC actually approaching IR35 compliance?

“What is IR35?” “What is an employment status assessment?”….“Can I stay outside it?” Do you have questions about the off-payroll working rules? You can find the answers here.

IR35 impacts all sectors and industries differently, but one common trend is the number of questions it generates. We’re constantly having conversations with organisations who are unsure about what they have to do, how they have to do it, and if they’re even ready for it. You’re always welcome to get in touch with us to discuss your issues directly, but you can get clarification now. These are our answers to your most commonly asked questions.